www.theokas-richner-gpp-tax-fraud.net

Thank you for your interest! What is this all about?

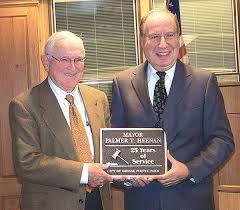

(Theokas at City Hall on right with Mayor Palmer Heenan on left)

- Former Grosse Pointe Park Mayor Gregory Theokas & Former Grosse Pointe Park City Councilman Andrew Richner committed PROPERTY TAX FRAUD by conspiring with the Tax Board of Review to get an artificially low assessed value of a commercial property they own in Grosse Pointe Park–which yielded them an illegal property tax discount of approximately $15,000 to $16,000 per year for and every year since 2011. So the fraud continues in perpetuity–so far 12 years and approximately $180,000 worth. In my view the statute of limitations for the crime has not run because the crime occurs every year.

- To boot the City of Grosse Pointe Park had the right to acquire the $835,600 valued property for delinquent property taxes of approximately $140,000 which would have yielded the city a windfall gain of approximately $700,000 and annual gross rental income in excess of $100,000 (net annual income of $40,000 to $50,000).

THE CRIME IN PICTURES:

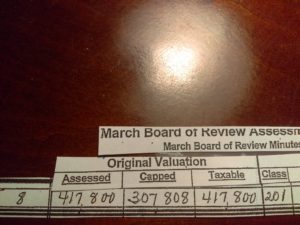

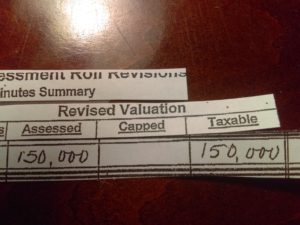

- Theokas & Richner purchased the property in 2010 which had an assessed value of $417,800 (1/2 the fair market value) in 2011 (see image above) before their meeting with the Tax Board of Review. The property taxes on the property before their purchase were approximately $25,000-$26,000 per year.

- Theokas & Richner met with the Tax Board of Review on March 24, 2011, the purpose of the meeting being to get the assessed value of their property adjusted–and were granted an illegal discount in the assessed value of their property from the $417,800 actual assessed value (see image above) to the $150,000 assessed value (see image below)—a jaw dropping 64 percent ILLEGAL discount!!!!!!!!!!!!! which dropped the annual property taxes on the property to $9,000 to $10,000 per year from $25,000 to $26,000 per year. By law a property’s assessed value must be 1/2 its fair market value!!!

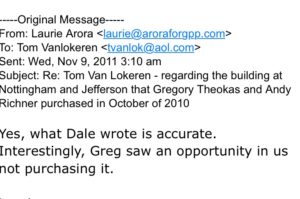

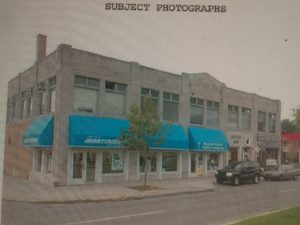

- The City of Grosse Pointe Park had the right to purchase the previously renovated 12,000 square foot commercial property at Nottingham and Jefferson (15324 East Jefferson)–3 blocks from City Hall (see image below) for the delinquent property taxes owed of approximately $140,000. That option was considered in a 2010, CLOSED SESSION City Council meeting. Mayor Pro Tem/City Council Member/Future Mayor, Gregory Theokas, dissuaded the City Council from voting to have Grosse Pointe Park acquire the property with an assessed value of $417,800 (2 times that equaling an $835,600 fair market value) for approximately $140,000 in delinquent property taxes. In the email below from City Councilwoman Laurie Arora she states “Greg saw an opportunity in us not purchasing it”. BOY DID HE SEE AN OPPORTUNITY–AN OPPORTUNITY FOR HIMSELF AND HIS PARTNER ANDREW RICHNER!!! The property valued at $835,600 was generating in excess of $100,000 in annual rent at the time. The city’s return on a $140,000 purchase price would have been between 30 to 40 percent per annum. In addition the city would have owned a half block of strategic real estate on Jefferson 3 blocks from city hall.

- But instead, Gregory Theokas and his partner Andrew Richner, having inside information and knowing everything about the property, purchased the property at a property tax auction in August of 2010.

The email below from City Councilwoman at the time, Laurie Arora, supports the assertion that Gregory Theokas, in that 2010 Closed Session City Council Meeting, dissuaded the City Council from acquiring the valuable 12,000 square foot strategic property–which he and Andrew Richner then went on to purchase for their own account later in the year.

So in summary:

To arrive at the claim on the billboard that THEOKAS & RICHNER OWE YOU, THE RESIDENTS OF GROSSE POINTE PARK, OVER ONE MILLION DOLLARS—My calculations are as follows:

$180,000 in lost property tax revenue over a 12 year period

A $695,600 loss in asset value (the city could have acquired an $835,600 propety for $140,000)

$40,000 to $50,000 a year in lost net rental income over a 12 year period — (12 times that) equals $480,000 to $600,000.

THE TOTAL OF THE ABOVE AMOUNTS IS WELL IN EXCESS OF THE MILLION DOLLARS CLAIMED!!! IF YOU READ THE LONG VERSION OF THE STORY BELOW YOU WILL DISCOVER THAT I HAVE BEEN SHOUTING FROM THE ROOFTOPS FOR A LONG TIME WITH MY MESSAGE FALLING ON DEAF EARS–LOTS OF DEAF EARS!

IF YOU CARE TO TAKE ACTION YOU CAN email the following parties directing them to www.GPPTaxFraud.com, asking them why they have not investigated these egregious violations of the public trust or demand that they do. I would like to hear from you too–you can reach me, Tom Van Lokeren, at tvanlok@aol.com

If our institutions cannot address this public corruption then we may have to do it together as citizens–with petitions, showing up at city council meetings, pressuring people in public office. So please email me so that we can develop a network of people to root out this public corruption in our own back yard. Thank you. Tom

The Grosse Pointe Park Police (Public Safety Department) publicsafety@grossepointepark.org

Michele Hodges, Mayor

hodgesm@grossepointepark.org

Judge Carl Jarboe …. court@grossepointepark.org

Thomas J. Caulfield, Mayor Pro-Tem

caulfieldt@grossepointepark.org

Vikas Relan Council Member

relanv@grossepointepark.org

Christine M. Gallagher Council Member

gallagherc@grossepointepark.org

Max A. Wiener Council Member

wienerm@grossepointepark.org

Martin D. McMillan Council Member

mcmillanm@grossepointepark.org

Brian Brenner Council Member

brennerb@grossepointepark.org

Detroit FBI Field Office: 313.965.2323

BELOW IS THE LONG VERSION OF THE ANALYSIS OF THE THEOKAS/RICHNER FRAUD

~WELCOME, ESPECIALLY TO THOSE WHO WOULD TAKE ISSUE WITH THEIR ELECTED & APPOINTED GOVERNMENT REPRESENTATIVES, USING THEIR POSITIONS TO PERSONALLY ENRICH THEMSELVES AT THE TAXPAYER’S EXPENSE~

~THE AMOUNT of OUR ANNUAL PROPERTY TAXES is SOMETHING WE DON’T HAVE MUCH CONTROL OVER...

THEY’RE COMPUTED BASED on ASSESSMENT LAW and REGULATIONS…

ONCE YOU’VE DIGESTED the FOLLOWING CHRONICLE of TWO GROSSE POINTE PARK POLITICAL FIGURES GAMING the PROPERTY TAX SYSTEM, WITH THE HELP OF OTHERS IN GOVERNMENT…

I URGE YOU to CONTACT THOSE…

THAT CAN INSTITUTE or PUT PRESSURE ON OTHERS TO INSTITUTE A...

FORMAL INVESTIGATION & PROSECUTION…

IT IS NOT TOO LATE!

THEIR NAMES and CONTACT INFORMATION CAN BE FOUND at the VERY END of THIS PAGE~

PLEASE KEEP IN MIND THAT: the U.S. Attorney’s office for the Eastern District of Michigan has indicted a slew of MACOMB COUNTY politicians and vendors over the past few years for public corruption in its various forms and permutations. Some of that corruption took place as far back as 2012. Many of them have pleaded guilty or have been found guilty at trial. Here are a few examples with the amounts of money involved and actual and potential sentences:

2020 Dino Bucci – Macomb County Public Works Deputy Commissioner Theft/Extortion $96,000 pleaded guilty – potential sentence of 10 years

2019 Dean Reynolds – Clinton Township Trustee Bribery/Corruption $150,000 went to trial and found guilty – sentenced to 17 years

2020 Eric Smith – Macomb County Prosecutor Public Corruption/Embezzlement $600,000 10 Criminal Indictments – potential sentence of 20 years

2018 Clifford Freitas – Macomb Township Trustee Bribery $42,000 – sentenced to 20 months

2016 Michael Lovelock – Chesterfield Township Supervisor Bribery $34,000 – sentenced to 24 months

WHY SHOULDN’T WAYNE COUNTY HAVE THE SAME INTOLERANCE TO PUBLIC CORRUPTION?

~Michigan Attorney General Dana Nessel~

“In exchange for the power to govern, public officials swear an oath of loyalty to the public interest. They don’t swear loyalty to their donors, their stock portfolios, their bank accounts, or even their families.”

“Government officials cannot be allowed to erode the public’s trust.”

As highlighted above, Macomb County has a problem with government officials engaging in criminal conduct and eroding the public trust…Wayne County has a problem too!

Former Grosse Pointe Park Mayor Gregory Theokas (left/top for mobile)…former Grosse Pointe Park City Council Member Andrew Richner (right/bottom for mobile)

DON’T LET the NICE SUITS DISARM YOU in to BUYING in to THEIR RESPECTABILITY and ETHICALITY!

~Both are lawyers with JDs from Harvard & University of Michigan respectively; both have held public office in Grosse Pointe Park; both have lived in Grosse Pointe Park for decades; and both crossed the line in to criminal conduct for which they should be held to account~

~below: 4 excerpts from the body of the website~

One must wonder and ask, if it was this easy for a taxpayer to be awarded such illegal, obscene and appalling property tax relief in a ten minute meeting with the Board of Review, how often has this happened and at what loss?

One must also wonder, with such unchecked power and authority vested in the Board of Review, where is the oversight of this body?

One must ask, if it was this easy for a valuable and strategic piece of real estate, to be railroaded right out of city hall by an influential pol, right in to his private domain for obscene private gain–how often has this happened and at what loss to the city treasury?

And how does the exception in the Open Meetings Act serve the public, which allows for real estate deliberations to happen in closed sessions, with minutes of those sessions never available to the public and allowed to be destroyed shortly thereafter.

THE PURSUIT OF THIS PRIVATE INVESTIGATION WAS THE OUTGROWTH OF A TIP FROM A BYSTANDER WHO WITNESSED WHAT TRANSPIRED IN A CORRUPT MEETING AT CITY HALL. THAT PURSUIT HAS REVEALED MUCH!

THANKS TO OUR DEMOCRACY and the FREEDOM OF INFORMATION ACT (FOIA) which allows members of the public to request information from public authorities – INFORMATION was OBTAINED FROM THE CITY OF GROSSE POINTE PARK in numerous FOIA REQUESTS in 2016 & 2017 revealing the CRIMINAL and UNETHICAL CONDUCT that is the subject of this website.

THE PROPERTY TAX APPEAL PROCESS in this account WAS TURNED IN TO A PROPERTY TAX FRAUD PROCESS!!! How did that Happen? CRONYISM!!

tap on image below to enlarge

~cronyism has many facets in the form of partiality to cronies~

It’s one thing to show partiality to cronies in actions that aren’t breaking the law…it’s quite another when the law is being broken. In the account that follows, the members of the Grosse Pointe Park Board of Review, consisting of Grosse Pointe Park residents; Margot Parker, Robert Buhl & William Finn, met with their cronies—at the time, current fellow official, Mayor Pro Tem Gregory Theokas and former City Council member Andrew Richner. Theokas & Richner asked the Board to do something illegal!

Theokas, a Harvard educated attorney and former Grosse Pointe Park City Council member, Mayor Pro Tem & Mayor from 1995 through 2015, had wheeled and dealed in real estate on behalf of Grosse Pointe Park for that entire time period. During his tenure, and with him an integral part of real estate planning, Grosse Pointe Park had acquired many real estate parcels and developed a number of projects (i.e. the library).

Again, keep in mind that he is an attorney, with loads of experience in real estate for Grosse Pointe Park. One must assume he knew property assessment law–what could be done and what could not be done as far as changing assessed values of property. He thought he could get away with what he & Richner cooked up in the reassessment of a property they had acquired–with the collusion of the Board of Review on March 24, 2011. The chances of them being found out were slim given the lack of oversight of that body in Grosse Pointe Park’s city government.

Evidence of the March 24, 2011 meeting with the Grosse Pointe Park Board of Review

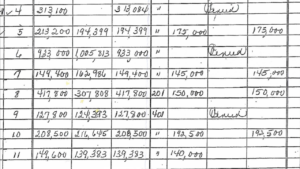

below: Board of Review’s worksheet–Item # 8 revealing the original assessed value and taxable value of $417,800 in columns 2 & 4 respectively and the revised assessed value and taxable value of $150,000 in columns 6 & 8 respectively

tap on image to enlarge

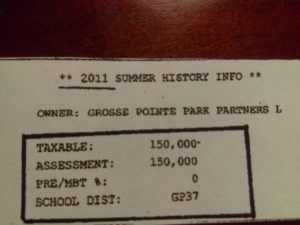

below: The revised property tax bill with the revised assessment value and taxable value–the outcome of the March 24, 2011 private tax assessment appeal meeting

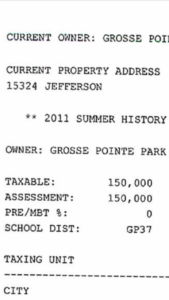

Theokas & Richner (aka Grosse Pointe Park Partners, LLC) 2011 property tax assessment & property tax bill

below: March 24, 2011 10:20 a.m. – Theokas & Richner appointment with Board of Review (the last entry on the sheet)

tap on or click on the image to enlarge

They asked the Board for an illegal reduction in the Assessed Value & Taxable Value of the commercial property they owned and essentially diverted from the city of Grosse Pointe Park (more on that later). Statutes and regulations that govern the assessment process of real estate, strictly prohibited what the Board did in that meeting. The Board really delivered!, giving their cronies, Theokas & Richner, an obscene, illegal 64 percent discount on the assessed value and the taxable value of their property, saving them an obscene amount of property taxes and that’s not the half of it.

A FOIA REQUEST REVEALED THAT THEOKAS & RICHNER PROVIDED NO SUPPORTING EVIDENCE (i.e. EXPERT TESTIMONY, APPRAISALS, ETC.) TO JUSTIFY THE MASSIVE REDUCTION IN ASSESSED VALUE GRANTED BY THE BOARD OF REVIEW. THE MEETING LASTED 10 MINUTES AND THE BOARD JUST RUBBER STAMPED THEIR REQUEST!

THIS WEBSITE chronicles wide spread CRONYISM, GRAFT, FRAUD & SELF DEALING in GROSSE POINTE PARK’S MUNICIPAL GOVERNMENT. THE PRICE to the city of Grosse Pointe Park in LOST PROPERTY TAX REVENUE, A LOST ASSET/INVESTMENT and LOST INVESTMENT INCOME IS CURRENTLY:

A CUMULATIVE LOSS OF $1,325,000~yes no typo here~One Million Three Hundred Twenty-Five Thousand Dollars!!

$175,000 in lost property tax revenue SO FAR ($350,000 in ANOTHER ten years)

$700,000 in a lost asset

$450,000 in lost investment income

Total $1,325,000

IT WASN’T ENOUGH to UNETHICALLY USE THEIR POLITICAL INFLUENCE to OBTAIN an $850,000 BUILDING for $265,400, GENERATING an ANNUAL RETURN on INVESTMENT of 30 to 35 PERCENT…THEY THEN gluttonously felt compelled to use their POLITICAL INFLUENCE to MASSIVELY CHEAT ON THEIR PROPERTY TAXES!

~THE CRIMINAL and UNETHICAL ACTS~

Should you have any questions regarding the following laws and their applicability to this case please don’t hesitate to email: tvanlok@aol.com

CRIMINAL ACT (#1 below)

1) Property tax fraud by an official and former official, Gregory Theokas and Andrew Richner, abusing the power of office, to unduly influence and coerce fellow officials; those on the Board of Review, to engage in illegal activity for the officials’ private gain. In this case the illegal activity was the Board of Review, in a tax appeal meeting, overriding the Grosse Pointe Park Assessor’s 2011 Original Assessed Value and Taxable Value of the property, illegally reducing the assessed value and the taxable value of the officials’ property by 64 percent, thereby discounting their 2011 property tax bill by $16,592.

The Board’s action in reducing the assessed value and taxable value in that 2011 tax assessment appeal meeting, had the affect of capping (in essence freezing) the taxable value of the property for future years, with slight annual adjustments for inflation. So going forward in every future year, the property taxes were computed based on the capped taxable value. The result was and still is, an obscene illegal property tax discount year after year in perpetuity, as long as the officials own the property.

The years so far, in which discounts have been received are: (2011, 2012, 2013, 2014, 2015, 2016, 2017, 2018, 2019 & 2020). The officials and beneficiaries of this graft, cronyism & fraud are Gregory Theokas (at the time of the tax appeal meeting-the current Mayor Pro Tem/City Council Member) and his partner Andrew Richner, a former Grosse Pointe Park City Council Member in the 1990s.

~CRITICAL…CRITICAL…KEY ANALYSIS BELOW~

PLEASE PAY EXTRA ATTENTION TO THE 2 PARAGRPAHS BELOW WHICH DESCRIBE A KEY ASPECT OF THE CRIMINAL SCHEME SHOWING THE IRREGULARITY AND LACK OF CONSISTENCY BETWEEN THE BOARD’S ACTIONS AND THE ASSESSOR’S ACTIONS

In 2012, the year following the discount, the Grosse Pointe Park Assessor, when she came to the subject property in the course of the annual reassessment of all Park properties, and by implication–that what the Board did in 2011 was illegal, overrode and completely reversed the Board of Review’s prior year illegal 64 percent reduction in assessed value, and properly assessed the property for 2012, raising it from $150,000 to $423,400.

Scandalously she failed to address the taxable value and failed to override and reverse the 64 percent reduction in taxable value which is what the computation of annual property taxes is based on. That value was only increased from $150,000 to $154,050. That failure had the effect of allowing the initial illegal 64 percent reduction to be applied to all future annual tax computations thus depriving Grosse Pointe Park of substantial property tax revenue.

Exhibit A

Exhibit B

In Exhibit A one can see the final 2011 assessed value and taxable value after the Board’s illegal revision to be $150,000 for both. Property tax calculations are based on the taxable value, which once established can only increase with annual inflation adjustments. So the taxable value established in 2011 effectively capped (froze) the basis upon which annual property taxes are computed.

In Exhibit B, one can see where the assessor, in her 2012 annual assessment of all Grosse Pointe Park properties, came across the subject property and wasn’t having the 2011 valuations that the Board came up with, $150,000. She re-established the true assessed value at $423,400. To be consistent she should also have re-established the true taxable value to that same level so that the property tax computation would be based on an accurate value.

Instead, she left the taxable value alone at $150,000 plus a $4,050 inflation adjustment, which allowed that to be the basis for all future property tax calculations with slight annual adjustments for inflation. The taxable value was now capped. The assessor, being a professional in her field, should have known that her failure was malfeasance and illegal and would result in significant future loss of property tax revenue. Below is the effect this had for just one year, 2012:

2012 Property taxes if calculated using correct taxable value – $26,835

2012 Actual Property taxes calculated and billed using illegal taxable value – $9,633

ACTUAL PROPERTY TAX REVENUE LOSS TO GROSSE POINTE PARK OF $17,202 for 2012

______________________________________________

UNETHICAL and POTENTIALLY CRIMINAL ACTS (#2 below)

2) Self dealing–abusing the power of office as Mayor Pro Tem, to unduly influence and coerce fellow officials on the Grosse Pointe Park City Council, to make a decision that was counter to the city of Grosse Pointe Park’s best interest (see email directly below from Laurie Arora, Grosse Pointe Park city council member at the time). The purpose of this undue influence and coercion was for private gain, the private gain of Grosse Pointe Park official, Mayor Pro Tem, Gregory Theokas and his partner Andrew Richner, at the expense and detriment of the city of Grosse Pointe Park.

The private gain amounted to $700,000. This loss was in the form of equity, in an asset that could have and should have been acquired by the city of Grosse Pointe Park for a relatively small cash outlay, had it not been for the unethical efforts of Gregory Theokas to steer this asset away from the city of Grosse Pointe Park in to his and his partner’s possession.

Below: In an email, City Council Member Laurie Arora, gives her summary of the closed session (closed session allowed by an exception in the Michigan Open Meetings Act–see below) City Council Meeting presided over by Mayor Pro Tem Gregory Theokas, in which the City Council discussed the possible acquisition of 15324 East Jefferson (the subject property in this website). In a foretelling of Greg Theokas’ post meeting purchase of the property she states “Greg saw an opportunity in us not purchasing it”.

The above statement taken on its face, would imply what was meant by Greg Theokas, was that it would better serve Grosse Pointe Park’s interest to let the opportunity pass and to not acquire the property.

What it really meant, was that Greg saw an opportunity for himself, in Grosse Pointe Park not purchasing the property, to pick the property up on the cheap at the tax foreclosure auction. And this is just what happened.

__________________________________________________________

OPEN MEETINGS ACT Act 267 of 1976

15.268 Closed sessions; permissible purposes. Sec. 8. A public body may meet in a closed session only for the following purposes:

(d) To consider the purchase or lease of real property up to the time an option to purchase or lease that real property is obtained.

15.267 Closed sessions; roll call vote; separate set of minutes…

These minutes shall be retained by the clerk of the public body, are not available to the public, and shall only be disclosed if required by a civil action…

These minutes may be destroyed 1 year and 1 day after approval of the minutes…

__________________________________________________________

One must ask, if it was this easy for a valuable and strategic piece of real estate, to be railroaded right out of city hall by an influential pol, right in to his private domain for obscene private gain–how often has this happened and at what loss to the city treasury?

And how does the exception in the Open Meetings Act serve the public, which allows for real estate deliberations to happen in closed sessions, with minutes of those sessions never available to the public and allowed to be destroyed shortly thereafter.

The collateral financial damage in opportunity cost for Grosse Pointe Park, in not acquiring the property, was an annual loss of approximately $50,000 in investment income–the net rental income from the property for 9 years (2011-2019) totaling $450,000 (9 x $50,000) and counting.

CRIMINAL ACT (#3 below)

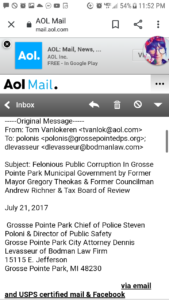

3) Public Corruption – the aiding and abetting of criminal activity, by top Grosse Pointe Park city officials–(Chief of Police, Municipal Court Judge, City Attorney, City Council, City Manager & Board of Review). This conduct, took place in the form of stonewalling the complainant in their choice to not respond to the property tax fraud charges alleged in the complaint and giving him the runaround. This allowed the offenders to continue their malfeasance unimpeded depriving the city treasury of substantial property tax revenue year after year unabated. These top government officials were made abundantly aware of the criminal conduct that had occurred and was continuing to occur right under their collective noses.

Further down the page you will find the supporting legal theories and analysis of the crimes that were perpetrated on the City of Grosse Pointe Park, but first the cast:

MEET THE CORRUPT BAD ACTORS

~The TWO principal OFFENDERS and BENEFICIARIES of criminal conduct~

GREGORY THEOKAS & ANDREW RICHNER

Above: Harvard educated former Grosse Pointe Park Mayor Gregory Theokas (above taking the oath of Grosse Pointe Park office).

Additional backround: HARVARD LAW SCHOOL GRADUATE & MBA – FORMER GROSSE POINTE PARK CITY COUNCIL MEMBER AND MAYOR (1995-2015) – 824 Bishop, Grosse Pointe Park, MI 48230 (313) 885-2158

___________________________________________

Above: University of Michigan educated, former Grosse Pointe Park City Council Member Andrew Richner (I’d be smiling too if I had increased my net worth by $662,500 (1/2 of the total illicit haul to date) with a little old fashion cronyism, back room dealing and a few strokes of the pen courtesy of the Board of Review and the City Council).

Additional Backround: UNIVERSITY of MICHIGAN Law School Graduate-former GROSSE POINTE PARK CITY COUNCIL MEMBER, former MICHIGAN STATE REPRESENTATIVE, former WAYNE COUNTY COMMISSIONER, former CHAIRMAN OF THE BOARD OF UNIVERSITY of MICHIGAN BOARD of REGENTS AND Last but Not Least (this is the real kicker!) PARTNER AT THE INTERNATIONAL LAW FIRM of CLARK HILL— Richner’s specialty is GOVERNMENT and PUBLIC AFFAIRS (how ’bout them apples?–I wonder if his client services include legal counsel on “how to defraud governments and public entities“). ANDREW RICHNER, 718 Berkshire, Grosse Pointe Park, MI 48230

___________________________________________

THE UNDULY INFLUENCED and COERCED “CRONIES”–THOSE WHO ENGINEERED the PROPERTY TAX FRAUD for THEOKAS & RICHNER’S ILLICIT FINANCIAL BENEFIT

GROSSE POINTE PARK BOARD OF REVIEW (CURRENT AND FORMER MEMBERS – MARGOT PARKER (current), ROBERT BUHL (dec’d 2016) & WILLIAM FINN (dec’d 2019)

Margot Parker

After serving on many Grosse Pointe Park Boards of Review, over a period of at least a decade and a half, Margot had to have known what kind of tax relief could legally be granted to taxpayers in the property assessment appeal process and what kind of relief could not be granted. This is where cronyism won the day. She eviscerated the law and regulations!

Robert Buhl (dec’d 2016)

Robert was a very close friend of offender Andrew Richner, a fellow University of Michigan alumnus and a fellow U of M booster. Cronyism won the day, in the private assessment appeal meeting.

William Finn (dec’d 2019)

Real Estate Agent

Cronyism again won the day, behind closed doors.

___________________________________________

AIDING & ABETTING CRIME! DERELICTION OF DUTY! FRAUD!

DIANN LULIS (dec’d 2017), FORMER GROSSE POINTE PARK TAX ASSESSOR

Assessor in 2011 & 2012, the years of criminal activity

_________________________________________

THE FOLLOWING THREE ENGAGED IN A DIZZYING EXERCISE OF OBFUSCATION AND PASSING THE BUCK!

Chief of Police Stephen Poloni, Municipal Judge Carl Jarboe & City Attorney Dennis Levasseur

GROSSE POINTE PARK POLICE CHIEF STEPHEN POLONI

BUCK PASSING! OBFUSCATION! VIOLATING THE PUBLIC TRUST! AIDING & ABETTING CRIME! DERELICTION OF DUTY!

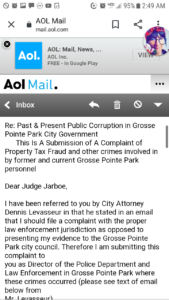

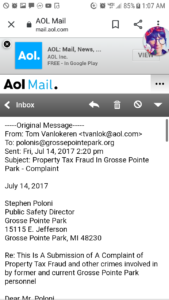

Below: The TOP COP, Police Chief Stephen Poloni CHOSE TO DISREGARD the allegations of PUBLIC CORRUPTION in the COMPLAINT SUBMITTED to him on SEVERAL OCCASIONS from different sources. HIS RESPONSE was NO RESPONSE.

~THE SHIFTING RESPONSIBILITY SHUFFLE~

1) JUDGE JARBOE, WHO INITIALLY RECEIVED THE CRIMINAL COMPLAINT, FORWARDED IT TO CHIEF POLONI IN AN EMAIL 2) IN CLASSIC PASSING THE BUCK FASHION, CHIEF POLONI IN AN EMAIL, FORWARDED THE COMPLAINT TO CITY ATTORNEY DENNIS LEVASSEUR AND COPIED JUDGE JARBOE AND THE COMPLAINANT ON THE EMAIL APPARENTLY TO KEEP THEM IN THE LOOP. 3) IT APPEARS CHIEF POLONI DID NOT THINK THE COMPLAINT FELL WITHIN HIS PURVIEW AND WAS EXPECTING THE CITY ATTORNEY TO RESPOND TO THE COMPLAINT BECAUSE HE DID NOT ACT 4) WHEN CITY ATTORNEY DENNIS LEVASSEUR WAS APPROACHED BY THE COMPLAINANT, HE INFORMED COMPLAINANT IN AN EMAIL THAT THE HEAD OF LAW ENFORCEMENT, CHIEF POLONI, WAS RESPONSIBLE FOR INVESTIGATING COMPLAINTS 5) THE COMPLAINANT THEN RESUBMITTED HIS COMPLAINT IN AN EMAIL DIRECTLY TO CHIEF POLONI. CHIEF POLONI DID NOT RESPOND IN ANY WAY TO THE COMPLAINANT ABOUT HIS COMPLAINT.

SIMPLIFIED-SHUFFLE-SCHEMATIC

COMPLAINANT TO JUDGE —-> JUDGE TO CHIEF —-> CHIEF TO CITY ATTORNEY (COPIES JUDGE & COMPLAINANT) —-> NO ACTION BY CHIEF —- > COMPLAINANT TO JUDGE —- > JUDGE BACK TO COMPLAINANT —- > CITY ATTORNEY TO COMPLAINANT —-> NO ACTION BY CHIEF —-> COMPLAINANT TO CHIEF —- > NO ACTION BY CHIEF

ULTIMATELY IT WAS CHIEF POLONI’S RESPONSIBILITY TO 1) RESPOND TO THE COMPLAINT 2) AND IN MY OPINION, GIVEN THE GRAVITY OF THE ALLEGED CRIMES IN THIS CASE, TO INVESTIGATE THE COMPLAINT. HE DID NEITHER.

__________________________________________________

GROSSE POINTE PARK MUNICIPAL COURT JUDGE CARL JARBOE

BUCK PASSING! VIOLATING THE PUBLIC TRUST! AIDING & ABETTING CRIME!

CHANCES ARE GOOD, GIVEN THE SERIOUSNESS OF THE ALLEGATIONS IN THE CRIMINAL COMPLAINT, THAT JUDGE CARL JARBOE WAS AWARE THAT CHIEF POLONI SAT ON THE COMPLAINT AND TOOK NO ACTION! THE COMPLAINANT URGED JUDGE JARBOE TO INVESTIGATE THE CRIMES, OFFERING UP AN EXAMPLE IN A MICHIGAN NEWS STORY, WHERE A JUDGE TOOK IT UPON HIMSELF TO INVESTIGATE A CRIMINAL MATTER. THAT ARTICLE ALSO STATED THAT AS A MATTER OF COURSE, IT CAN BE WITHIN A JUDGE’S PURVIEW TO INVESTIGATE A MATTER! IN MY OPINION THIS SHOULD HAVE BEEN ONE OF THOSE CASES IF CHIEF POLONI FAILED TO ACT. IT WOULD SEEM THAT JUDGE JARBOE HAD A FIDUCIARY RESPONSIBILITY TO STEP IN TO THE BREACH!

________________________________________________

GROSSE POINTE PARK CITY ATTORNEY DENNIS LEVASSEUR

BUCK PASSING! VIOLATING THE PUBLIC TRUST! DERELICTION OF DUTY !

CITY ATTORNEY DENNIS LEVASSEUR KNEW WELL THAT CHIEF POLONI SAT ON THE CRIMINAL COMPLAINT AND TOOK NO ACTION! HIS JOB WAS AND IS TO REPRESENT AND LOOK OUT FOR THE BEST INTERESTS OF HIS CLIENT, THE CITY OF GROSSE POINTE PARK. PART OF THAT RESPONSIBILITY IS PROTECTING THE ASSETS OF HIS CLIENT AND PROTECTING HIS CLIENT FROM PUBLIC CORRUPTION. HE WAS WELL AWARE OF THE ILLEGAL ACTIVITIES AND HAD A FIDUCIARY RESPONSIBILITY TO ACT!

_________________________________________________

AIDING AND ABETTING! VIOLATING THE PUBLIC TRUST!

CERTAIN MEMBERS OF THE GROSSE POINTE PARK CITY COUNCIL

&

GROSSE POINTE PARK CITY MANAGER

THEY ALL LOOKED THE OTHER WAY-AFTER HAVING BEEN MADE AWARE OF THE PUBLIC CORRUPTION IN THEIR MIDST A DOZEN TIMES OR SO!

Robert Denner – city council member at the time–now the current mayor.

Daniel Grano – city council member at the time and currently a city council member.

James Robson – city council member at the time and currently a city council member.

Daniel Clark – former city council member.

Former city council member Barbara Detwiler.

Former city council member John Chouinard.

Former Grosse Pointe Park City Manager Dale Krajniak

______________________________________________

LEGAL ANALYSIS AND EVIDENCE OF THE CRIMES (#1 & #3) and UNETHICAL and POTENTIALLY CRIMINAL ACTIVITY (#2):

1 PROPERTY TAX FRAUD & ABUSE OF POWER/ABUSE OF PUBLIC OFFICE

2 UNETHICAL & POTENTIALLY CRIMINAL SELF DEALING AND ABUSE OF POWER/ABUSE OF PUBLIC OFFICE

3 PUBLIC CORRUPTION-AIDING AND ABETTING

Should you have any questions regarding the following laws and their applicability to this case please don’t hesitate to email: tvanlok@aol.com

_______________________________________________

1) PROPERTY TAX FRAUD &

ABUSE OF POWER/ABUSE OF PUBLIC OFFICE

SMOKING GUN # 1 (see both images below)

ABOVE–March 2011 Board of Review’s documentation on subject property owned by Theokas & Richner–showing its original assessed value before the private, tax assessment appeal meeting on March 24, 2011 with the 3 members of Grosse Pointe Park’s Board of Review*. The assessor’s original valuation of (above image) $417,800 produced an annual property tax bill of $25,877. This is the amount that would have been due from Theokas & Richner for 2011 had they not met with the Board of Review and appealed their assessment.

*The Board of Review is a body of 3 residents of Grosse Pointe Park who are appointed by the City Council, to meet with taxpayers in March of every year, who want to appeal their property’s assessed value in order to lower their annual property tax bill.

ABOVE–March 2011 Board of Review’s documentation with subject property’s revised assessed value and taxable value by the Board of Review, $150,000 (a $267,800 reduction) after the private tax assessment appeal meeting with the Board of Review–resulting in revised annual property taxes of $9,285–down from $25,877. $9,285 is what they were ultimately billed and what they paid, for 2011. Their illegal tax savings for 2011–$16,592. They were just getting started!

WHY DID THE BOARD OF REVIEW MAKE THIS ILLEGAL ACCOMMODATION?

Because Gregory Theokas was Mayor Pro Tem–Mayor Palmer Heenan’s right hand man for 16 years and had been in Grosse Pointe Park city government for 16 years and was a friend and colleague of long time Board of Review Member Margot Parker who was appointed by Mayor Palmer Heenan.

Because Gregory Theokas was a member of the City Council that approved Mayor Palmer Heenan’s appointment of Margot Parker’s to the Board of Review.

Because Andrew Richner was great friends with Board of Review Member Robert Buhl, a fellow University of Michigan alumnus and sports booster.

WHAT WAS IN IT FOR THEM?

It made them feel important; being in a position of power to help those in power–to become a member of the club and to be owed. It’s called cronyism. It’s called public corruption.

There was very little chance that their indiscretion would be discovered. It was actually a fluke that it was but that’s another story.

WHY ARE THE ABOVE IMAGES EVIDENCE OF PROPERTY TAX FRAUD?

Because the methodology used by the Board of Review in the private tax assessment appeal meeting referenced above–was illegal–granting a whopping illegal property tax discount of $16,592 for 2011 (correct tax of $25,877 less the bogus revised tax of $9,285) to Theokas & Richner. That methodology capped the taxable value at $150,000 for 2011. Going forward that low capped tax value (with small adjustments for inflation) has resulted in deeply discounted illegal property taxes in 2012 through 2020. That will also be the case for 2021 and beyond. To partially illustrate, the illegal discounts were computed for 2012 through 2015:

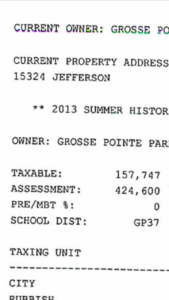

Had the Grosse Pointe Park Assessor’s 2011 Assessed Value & Taxable Value of $417,800 (see above image) remained in place for purposes of computing the 2012 taxable value, that computation would have been $417,800 increased by a inflation factor of 2.7 percent resulting in a 2012 taxable value of $429,081 and yielding a property tax bill of $26,835. Theokas & Richner’s 2012 actual tax bill was $9,633 based on a taxable value of $154,050 . The illegal discount for 2012 was $17,202–a loss of that amount of tax revenue to the City of Grosse Pointe Park.

The calculation of lost property tax revenue for 2013 through 2015 was the following:

2013: True and proper calculated tax of $28,018 less incorrect illegal tax billed to taxpayers—$10,020 (based on taxable value of $157,747-image below) equals lost property tax revenue of $17,999. Assessed Value (SEV) – $424,600/Taxable Value $157,747/True Cash Value=fair market value (2 x SEV) $849,200

Theokas Richner (aka Grosse Pointe Park Partners, LLC) 2013 property tax assessment & property tax bill

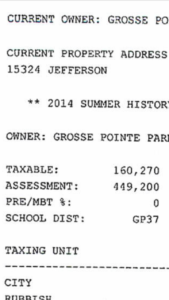

2014: True and proper calculated tax of $29,384 less incorrect illegal tax billed to taxpayers—$10,541 (based on taxable value of $160,270-image below) equals lost property tax revenue of $18,843. Assessed Value (SEV) – $449,200/Taxable Value $160,270/True Cash Value=fair market value (2 x SEV) $898,400

Theokas Richner (aka Grosse Pointe Park Partners, LLC) 2014 property tax assessment & property tax bill

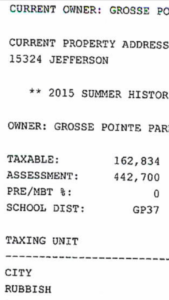

2015: True and proper calculated tax of $30,100 less incorrect illegal tax billed to taxpayers—$10,831 (based on taxable value of $162,834-image below) equals lost property tax revenue of $19,269. Assessed Value – $442,700/Taxable Value $162,834/True Cash Value=fair market value (2 x SEV) $885,400

Theokas Richner (aka Grosse Pointe Park Partners, LLC) 2015 property tax assessment & property tax bill

Summary: total lost property tax revenue for years 2011 through 2015:

$16,577 – 2011

$17,202 – 2012

$17,999 – 2013

$18,843 -2014

$19,269 -2015

$89,890 Total for 5 years

Extrapolate that out for:

10 years and you’re easily in the $200,000 range

20 years and you’re well above the $400,000

SMOKING GUN # 2 (see both images below) ASSESSOR CAUGHT IN THE ACT

And by the way–lest you think there was a valid, legal and sound reason, for the Board of Review to have discounted the assessed value and tax value of the property by 64 percent in 2011– in the year following the discount, 2012, the Grosse Pointe Park Assessor, when she came to the subject property in the course of the annual reassessment of all Park properties, and by implication–that what the Board did in 2011 was illegal, overrode and completely reversed the Board of Review’s prior year illegal 64 percent reduction in assessed value and properly assessed the property for 2012, raising it from $150,000 to $423,400.

Scandalously she failed to override and reverse the 64 percent reduction in taxable value which is what the computation of annual property taxes is based. That value was only increased from $150,000 to $154,050. That failure had the affect of allowing the initial illegal 64 percent reduction to be applied to all future annual tax computations thus depriving Grosse Pointe Park of substantial tax revenue.

In subsequent years beyond 2012, 2013 through 2015, Grosse Pointe Park’s Assessor, assessed the value (SEV) in the $400,000 to $450,000 range: 2013-$424,600, 2014-$449,200, 2015-$442,700. Information on the assessed values beyond 2015 were not obtained.

In subsequent years beyond 2012, 2013 through 2015, Grosse Pointe Park’s Assessor, assessed the taxable value in the $150,000 to $165,000 range: 2013-$157,747, 2014-$160,270, 2015-$162,834. Information on the assessed taxable values beyond 2015 were not obtained.

Smoking Gun # 2

SO WHAT WAS THE LAW THAT WAS BROKEN, THE STATUTE THAT WAS VIOLATED OR THE RULES & REGULATIONS THAT WERE BROKEN BY THE BOARD OF REVIEW, TO ARRIVE AT THE CONCLUSION THAT PROPERTY TAX FRAUD WAS COMMITTED BY THE BOARD OF REVIEW AND THEOKAS & RICHNER?

1) The well accepted and universally applied statutory law, Section 211.27 (1) of THE GENERAL PROPERTY TAX ACT of Michigan, was violated, and states in part:

“A sale or other disposition by this state or an agency or political subdivision of this state, of land acquired for delinquent taxes ………… ………… ……….. ………. ……….. ………. is not controlling evidence of true cash value for assessment purposes.”

2) Regulations to be followed by Boards of Review in their assessment activities are found in the Guide for Boards of Review as provided by the Michigan State Tax Commission. The following are excerpts from the relevant section of the guide that apply to what the Board of Review & Theokas & Richner engaged in:

2) UNETHICAL AND POTENTIALLY CRIMINAL SELF DEALING & ABUSE OF POWER/ABUSE OF PUBLIC OFFICE:

TO UNDULY INFLUENCE AND COERCE FELLOW OFFICIALS FOR THE ULTIMATE PURPOSE OF PRIVATE GAIN

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

IT is THE CONTENTION of THE AUTHOR of this WEBSITE that from MANY STANDPOINTS including financial & strategic, the city of GROSSE POINTE PARK WOULD HAVE and SHOULD HAVE chosen to PURCHASE the PROPERTY that is the subject of this website — if not for the UNDUE INFLUENCE of GREGORY THEOKAS over the City Council and his intent to SELF DEAL for PRIVATE GAIN

$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$$

To add insult to injury the city of Grosse Pointe Park in 2010, had under Michigan tax foreclosure law, the legal right to purchase the property, directly from Wayne County, the legal owner after its tax foreclosure, that was valued by the tax assessor at $887,000 (2 times the 2010 SEV of 443,500).

The purchase price for Grosse Pointe Park in 2010 would have been a mere sum approaching $140,000 (the amount of delinquent property taxes)–which strategically would have made sense–for Grosse Pointe Park to own a classic, recently overhauled and upgraded ($400,000 spent by former owners in improvements) 12,020 square foot vintage building, controlling a half city block on Jefferson, between Nottingham & Beaconsfield, for ongoing city planning purposes–especially for the minimal capital outlay and the 30 to 40 percent annual return it would have yielded in net rental income.

What city wouldn’t jump at the chance to buy a piece of property worth $887,000 for $140,000?

Subject property (below), 15324 East Jefferson (1/2 block starting at Nottingham going toward Beaconsfield) the other half of the block is the gas station.

The 12,020 square foot property has four commercial spaces on the first floor (among the tenants-Hungry Howies) and 9 office spaces on the second floor and generates gross rents of approximately $120,000 per year and a cash on cash return on investment for Theokas & Richner of approximately 30 to 35 percent per year. Its SEV (assessed value) and its taxable value was illegally and shockingly discounted for property tax purposes by the Board of Review to $150,000 from $417,800(a 64 percent discount).

Over the years, Grosse Pointe Park has engaged in many acquisitions and the development of real estate within its borders. In the summer of 2010, City Council Member and Mayor Pro Tem at the time, Gregory Theokas, presiding over a closed door city council meeting to discuss the possible acquisition of the subject property, dissuaded the City Council from opting to have Grosse Pointe Park acquire the property. City council member at the time, Laurie Arora, was in that meeting and in a post meeting email to me in response to an inquiry, regarding that meeting, stated the following in a BOMBSHELL EMAIL:

Yes, Gregory Theokas saw an opportunity in Grosse Pointe Park “not purchasing” the property alright! Mayor Pro Tem Gregory Theokas, bought it for his own account a few months after the summer city council meeting, in the fall of 2010, at the Wayne County tax foreclosure auction, with partner Andrew Richner!

Using his influence in the affairs of city government, he steered this valuable, strategic property away from ownership by Grosse Pointe Park right in to his and Richner’s real estate portfolio.

They paid $265,400 in cash for the $887,000 property at the tax foreclosure auction and based on their purchase price of $265,400 their return on investment is estimated to be a staggering 30 to 35 percent per annum.

The return on investment would have been higher for Grosse Pointe Park ($140,000 purchase price vs. Theokas & Richner’s purchase price of $265,400) and could have accrued to the city of Grosse Pointe Park if it had exercised its legal right to purchase the property. Grosse Pointe Park’s $140,000 cost of the property, would have been recovered in a matter of four to five years given the substantial return on investment.

The bottom line is that Theokas used his Mayor Pro Tem position, unethically in unduly influencing his fellow city council members in a city council meeting, to pass up an extraordinary real estate opportunity for the city.

He and Richner then used inside information about the property, only known to city officials, to favor themselves in being the top bidder at the property tax foreclosure auction, allowing them to reap windfall returns on their ill gotten property investment, year after year, that could have accrued to the city of Grosse Pointe Park.

Theokas had inside information and knew everything about the property, via his position as Mayor Pro Tem/City Council Member. Detailed financial information about the property had been provided by the former owner to the city of Grosse Pointe Park in the spring of 2010 before the fall auction. This information allowed Theokas & Richner to outlast the other bidders, knowing that the true value of the property was close to it’s assessed true cash value of $887,000 (2 x SEV of $443,500). Their winning bid was $265,400 at the property tax foreclosure auction for the subject property, a 12,020 square foot commercial property worth, as stated before, $887,000 (and valued as such by the assessor before the illegal discount).

__________________________________________________

3) PUBLIC CORRUPTION – AIDING AND ABETTING CRIME

All of the officials featured below, in one way or another, abdicated their responsibility to address the criminal activity that took place–criminal activity that they had been made aware of. A number of those individuals currently do not hold office now as a result of retiring, being voted out, etc.

It was a case of hear no evil, see no evil and speak no evil and PASS THE BUCK!

THIS had to be a COVER UP! It would be nigh impossible to explain it away as COLOSSAL INCOMPETENCE and INEPTITUDE!

Below–the chronology of OFFICIALS’ TORTUOUS EMAIL HAND OFFS, OF A Criminal Complaint, PASSING THE BUCK WITH ULTIMATELY NO ONE TAKING RESPONSIBILITY, protecting their criminal cronies!

I reported the illegal activities in 2017 to all City Council Members via email and regular usps mail. None of the City Council Members responded to me. Apparently they didn’t because it is technically not in their purview to investigate and prosecute crimes. One would think that they should have pointed me in the right direction. One also might think that it was incumbent upon them to follow up on the status of allegations of public corruption by former Grosse Pointe Park government officials robbing the city coffers. It also would seem that they had a fiduciary duty to follow up with law enforcement to see if the corruption that they had been made aware of was being addressed.

Former City Manager Dale Krajniak was also made abundantly aware of the illegal activities engaged in by former Mayor Gregory Theokas, Andrew Richner, the Board of Review and the Assessor through being copied on emails and other communications.

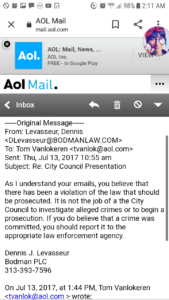

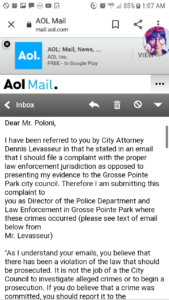

I also reported the illegal activities to the City Attorney, Dennis Levasseur. He was aware that I had contacted the members of the city council, and he expressed to me in an email “it is not the job of the City Council to investigate alleged crimes or to begin a prosecution. If you believe that a crime was committed, you should report it to the appropriate law enforcement agency” (see email below).

Notably, he failed to specify the particular law enforcement agency I should report it to. His vague and indifferent response would suggest that he really wasn’t interested in seeing this complaint progress to an investigatory stage. Otherwise he would have offered a more specific road map on how I should have proceeded. As City Attorney, it is his job to look out for the best interests of the city which would seemingly include preventing fraud and corruption and protecting the assets of the city.

email (below) – City Attorney Dennis Levasseur informing complainant that he needs to report criminal activity to the head of law enforcement.

Tap on or click on the image to enlarge

My guess was after not receiving specific guidance from the City Attorney as to exactly who to contact about illegal activities, was that the appropriate law enforcement agencies would be the court and the police so my starting point was to report the illegal activities first to Municipal Judge Jarboe (see email below).

Tap on or click on images below to enlarge

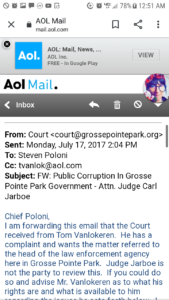

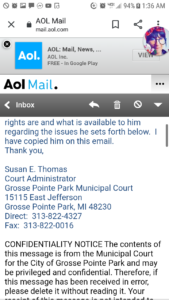

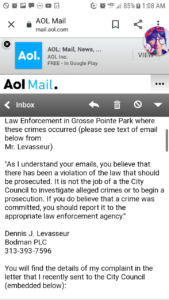

Judge Jarboe’s office, in response to my submission of a criminal complaint, forwarded my email to current Police Chief Stephen Poloni stating in their transmittal email (see email below) that “He has a complaint and wants the matter referred to the head of the law enforcement agency here in Grosse Pointe Park. Judge Jarboe is not the party to review this. If you could do so and advise Mr. Van Lokeren as to what his rights are…” . I am copied on this email to Police Chief Poloni.

email (below) – Judge Jarboe’s office forwarding the criminal complaint, that was submitted to him. In the email Jarboe requests that Chief Poloni handle the matter.

Tap on or click on the images below to enlarge

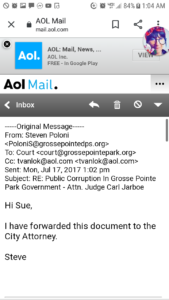

Reiterating, in the email (image above) Jarboe’s office requests that Poloni contact me–“If you could do so and advise Mr. Van Lokeren as to what his rights are…”. I assumed that meant “what my rights were” with regard to filing a criminal complaint. Chief Poloni does not honor Jarboe’s request to contact me and instead forwards to the City Attorney, the complaint submitted to Judge Jarboe’s office. He then emails Judge Jarboe’s office, copying me (email below), informing Jarboe that he has forwarded complaint to City Attorney Dennis Levasseur, who had just recently sent me an email informing me that I needed to contact the appropriate law enforcement agency.

Does runaround come to mind?

email (below) – Chief Poloni’s email, informing Judge Jarboe’s office, that he forwarded the complaint (sent to him by Jarboe’s office) to City Attorney Levasseur. Poloni copies me, the party who submitted the complaint.

Tap on or click on the image below to enlarge

Judge Jarboe’s office, in an additional email to me, in response to my assertion with an example, of how a judge will sometimes initiate an investigation, conveyed to me in no uncertain terms, that it’s the job of the police to investigate this crime (excerpt below):

“I have forwarded your matter to the Chief of Police, Stephen Poloni. If you have a complaint of this nature you would go through the police department. The Judge would be the one to hear whatever charges or complaint that comes from the police department and prosecutor and adjudicate the matter.”

1) Since Chief Poloni failed to contact me regarding my complaint, disregarding Judge Jarboe’s instruction that he do so and 2) since Chief Poloni instead of addressing my complaint, forwarded the complaint to the City Attorney after receiving it in an email from Jarboe’s office and 3) since City Attorney Dennis Levasseur instructed me to report the crimes elsewhere to the appropriate law enforcement agency, it left me with two courses of action to END THE TORTUOUS RUNAROUND AND TO CLOSE THE LOOP 1) submit my complaint in an email directly to Chief Poloni (email 1 below) and 2) submit my complaint in one email, to both Chief Poloni and City Attorney Dennis Levasseur (email 2 below).

I did both and RECEIVED NO RESPONSE–PERIOD!. THE LONG and the SHORT OF IT—I GOT the SILENT TREATMENT from THE TOP COP and the runaround and ultimately the silent treatment from THE TOP LEGAL OFFICIAL in GROSSE POINTE PARK’S MUNICIPAL GOVERNMENT.

ONE CANNOT HELP BUT ASK “WHAT IN GOD’S NAME WENT ON HERE?”

I STRONGLY SUSPECT it was CRONYISM for some and CRONYISM and a COVER-UP for others–IN a very RELAXED and CASUAL GOVERNMENT CULTURE, with LITTLE OVERSIGHT, and the LEGAL RIGHT to DELIBERATE on MATERIAL MATTERS LIKE REAL ESTATE TRANSACTIONS BEHIND CLOSED DOORS (GRANTED by an EXEMPTION in MICHIGAN’S SUNSHINE LAW).

email 1 – partial email to Chief Poloni submitting a complaint of criminal activity

Tap on or click on the images below to enlarge

email 2 – email to Chief Poloni & City Attorney Dennis Levasseur inquiring as to whether they are going to investigate the criminal activity.

Tap on or click on the images below to enlarge

Hopefully you read the text above and some of the damning emails above. What took place was some serious shirking and shifting of responsibility,and in my opinion, tantamount to dereliction of duty! Not one of the officials took the matter up, to protect the city of Grosse Pointe Park–the entity that they owed a fiduciary duty to!

May 29, 2020

To the residents of Grosse Pointe Park:

It is incumbent upon me, to bring to your attention, the shocking criminal and unethical activity that took place in 2011 and 2012 and the ongoing criminal and unethical activity taking place, engaged in by former Grosse Pointe Park municipal government officials–former Mayor Gregory Theokas & former City Council Member Andrew Richner and others.

Over the last several years I have brought these activities to the attention of numerous government officials and agencies with the goal of spurring an investigation and prosecution. This effort sadly has failed to yield results. Therefore as a last resort I bring the matter to you, the honest, hard working, tax paying citizens of Grosse Pointe Park & Wayne County via this website.

I know this activity initially occurred quite some time ago in 2011 & 2012–but what was set in motion in 2011 & 2012, has serious current ramifications, in that it has allowed the offenders, Gregory Theokas and Andrew Richner, to benefit from substantial annual illegal property tax discounts from 2011 to the present that will continue every year into the future as long as they own the property.

In addition Grosse Pointe Park has been deprived of annual investment income of approximately $50,000, from an asset it should have acquired for a relatively small sum . That asset, instead, was acquired by Gregory Theokas & Andrew Richner, to the financial detriment and deprivation of the city of Grosse Pointe Park.

From the time I found out in 2016, about this public corruption in Grosse Pointe Park’s municipal government, I have been shouting from the rooftops to those who had the power to bring the offenders to justice. That shouting has repeatedly fallen on deaf ears. Maybe this website will cause enough civic outrage toward these activities and the aiding and abetting by government officials, past and present, for it to come to a fitting, necessary and just end.

I ask for your help in raising community awareness of this public corruption in our midst and in getting it investigated and prosecuted. Since the illegal discounts and the annual loss in investment income are occurring every year in perpetuity, I do not believe any statute of limitations protecting the offenders would apply.

If you are offended and or appalled by this deplorable corruption in your own back yard, please email some or all of the parties listed at the bottom of this page to voice your outrage and demand accountability.

At a minimum, since apparently the buck stops with the head of law enforcement, please email Police Chief Stephen Poloni (PoloniS@grossepointedps.org) and demand a long overdue investigation in to these matters. Also there are a number of other city officials and their emails listed below to email. Perhaps you could copy me — which will be held in strict confidentiality.

Thank you so much!

Sincerely,

Tom Van Lokeren ( contact: tvanlok@aol.com )

p.s. – Should you have any questions or comments please don’t hesitate to email: tvanlok@aol.com

Evidence of the fraud in pdf format has been uploaded to the top of a Page named Proof/Documentation . . . Click on this link. On that particular page you will see the full 2010, 2011, 2012, 2013, 2014 & 2015 property tax bills and the Tax Board of Review’s full notes from the meeting showing the illegal activities.

________________________________________

Please voice your outrage via email to:

Police Chief of GP Park – Steven Poloni PoloniS@grossepointedps.org

Judge Carl Jarboe

court@grossepointepark.org

Mayor of Grosse Pointe Park, Robert Denner –

dennerb@grossepointepark.org

Wayne County Prosecutor – prosecutor@waynecounty.com

State of Michigan Fraud Investigation Unit – ReportTaxFraud@michigan.gov

Grosse Pointe Park City Attorney Dennis Levasseur – DLevasseur@BODMANLAW.COM

Council Member James E. Robson (this man had a former career in law enforcement!!!)

robsonj@grossepointepark.org

Mr. Robson is currently retired from his profession and has worked as a police commander and law enforcement instructor.

Council Member Lauri Read

readl@grossepointepark.org

(313)717-8777

Lauri, is an attorney in private practice and is a partner with Keller Thoma, PC in Southfield.

Council Member Vikas Relan

relanv@grossepointepark.org

Council Member Aimee Fluitt (she used to work for the FBI!!!!!)

fluitta@grossepointepark.org

Aimee spent 15 years working in national security with the FBI and NASA

Council Member Daniel C. Grano (this man’s career is in law enforcement!!!!!)

granod@grossepointepark.org

Mr. Grano is currently an Assistant Attorney General for the State of Michigan. He is assigned to the Criminal Division and prosecutes crimes arising in the Detroit casinos, illegal gambling operations around the state, state tax crimes, and special assignments.

Council Member Michele Hodges

hodgesm@grossepointepark.org

Please hold your city officials accountable and make an example of those exposed in this website. That example can be a deterrent to future corruption. A good start would be to email the officials above. Perhaps you could copy me — which will be held in strict confidentiality.

Sincerely,

Tom Van Lokeren

tvanlok@aol.com